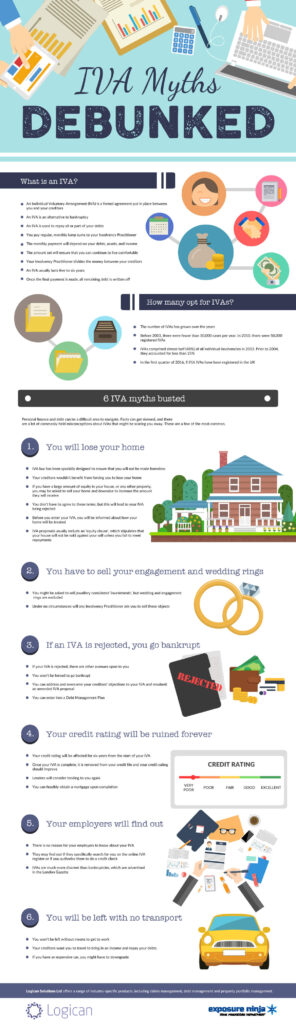

Getting to grips with personal finance and debt management options can be a difficult process. There are a lot of pervasive misconceptions flying around that often go unquestioned. Coping with debt is never easy and it is made all the more challenging when you aren’t really afforded a clear and accurate picture of the avenues of management available to you.

What are IVAs?

An Individual Voluntary Arrangement (IVA) is an alternative to bankruptcy in the form of a formal, binding agreement between you and your creditors. An IVA is put in place to ensure that you pay off at least part of your debts in the form of regular, monthly payments. These payments go to your Insolvency Practitioner, who will then divide the money between your creditors.

The amount of this monthly payment will depend on the extent of your debts, the value of your assets and your monthly income. If you don’t have a regular income, your proposal for an IVA is not likely to be accepted. The amount of money you pay out will ensure that you can continue to live comfortably, though certainly not lavishly. An IVA usually lasts up to six years and once the final payment is made, the remaining debt is written off.

How many people opt for IVAs?

The number of IVAs registered has grown over recent years. Fewer than 10,000 cases were reported prior to 2003, whereas in 2010 more than 50,000 IVAs were registered. IVAs comprised 48% of all individual insolvencies in 2013, which is a significant increase from the 25% prior to 2004. In the first quarter of 2016 alone, 9,916 IVAs have been registered in the UK

6 IVA myths busted

To put your mind at ease, here are the six most misrepresented IVA ‘facts’ that you likely will have heard, and the truth behind them.

1. You will lose your home

The possibility that you might lose your family home would deter anyone from exploring the option of an IVA. Fortunately, IVA law has been specially designed to ensure that this will not happen. You will not be left homeless, as this flies in the face of what an IVA is trying to accomplish. Your creditors want you to remain on your feet so you can continue bringing in money to repay your debts.

Assuming you have an extremely large amount of equity in your home, you might be asked to downsize in order to increase the amount of money payable to your creditors. If you refuse to do so, your IVA will more than likely be rejected, but you will never be forced to sell your home. An IVA usually comes with an ‘‘equity clause’, which exists to remove ambiguities relating to equity and what will happen if you fail to make repayments. Before you enter into your IVA, you will be informed about how your home will be treated.

2. You have to sell your engagement and wedding rings

It is true that you might be asked to sell some valuable items considered ‘investments’, including jewellery, to increase the amount you are able to repay. However, engagement and wedding rings are exempted from this. It is important to know that under no circumstances will any Insolvency Practitioner ask you to sell these items.

3. If an IVA is rejected, you go bankrupt

There are certainly more options available to you should your IVA be rejected. To begin with, you can actively address and overcome any objections your creditors may have against your IVA. You can then amend and resubmit your IVA proposal, which will probably be accepted. Alternatively, you can also enter into a Debt Management Plan (DMP). For more information, discuss your options with your Insolvency Practitioner.

4. Your credit rating will be ruined forever

Your credit rating will indeed be affected for six years from the start of your IVA. However, once your IVA is complete and it is removed from your credit file, your credit rating will begin to improve if you make the right financial decisions. Lenders will consider lending to you again and you can even look into obtaining a mortgage.

5. Your employers will find out

There is no reason for your existing employer to find out about your IVA. They can discover its existence in two ways: they can perform a specific search on an online IVA register, or you can authorise them to do a credit check. For this reason, the only way someone might find out about your IVA is if they are a potential employer. Thankfully, IVAs enjoy a much higher level of discretion when compared to bankruptcies, which are still advertised in the London Gazette.

6. You will be left with no transport

As with the possibility of losing your home, this is a myth that makes little to no financial sense, as your creditors will want you to have a means to get to work and bring in a reliable income. You might be asked to sell and downgrade your car if you have an expensive model, but you will never be left without a way of getting to work

This infographic was brought to you by Logican. Please feel free to add this infographic to your own website by copying and pasting the following embed code onto a page or post: