MSM Claims Processing Software

Why you need it if you manage Mis-Sold Mortgage claims.

Purpose built Mis-Sold Mortgage claims processing software is an invaluable tool for claims management companies handling mortgage mis-selling claims, in part because this generally involves the claims manager in working in simultaneous partnership with multiple legal firms.

A purpose designed Mis-Sold Mortgage system not only automates the repetitive process tasks involved in MSM claims; it also simplifies the administrative workload associated with tracking commissions to solicitors, no matter how many legal firms a claims manager might be partnering with.

This is particularly relevant in the mortgage mis-selling field, as claims require legal action against the lender (usually a bank or building society), which cannot be executed without the services of a solicitor.

Why it’s so important to choose the right Mis-Sold Mortgage claims processing software.

Unlike other types of compensation claim, Mis-Sold Mortgage claims tend to be relatively low in volume, but each case may have a significant value, making this a potentially profitable line of business.

However, the accounting forensics and legal process involved, and the time taken by lenders to respond at each stage, can make cases difficult to manage, impacting on their profitability.

While there are a number of software solutions marketed as Mis-Sold Mortgage Claims Management systems, thoughtfully designed and custom featured Mis-Sold Mortgage claims software is substantially more effective in reducing the manpower required to progress claims and keep these on track.

A good quality Mis-Sold Mortgage system will also minimise the work involved in managing the commissions due to partner solicitors, which can otherwise prove time consuming and costly.

What challenges can good Mis-Sold Mortgage software help you overcome?

By deploying good Mis-Sold Mortgage software, a claims company can manage its caseload with the increased efficiency required to ensure healthy margins are maintained.

Tracking the progress of Mis-Sold Mortgage claims, gathering together the information relating to the claims and chasing up clients for forms of authority can all be automated and streamlined, as can the instructing of the necessary forensic accounting.

The volume documentation involved in Mis-Sold Mortgage cases can also be brought under control, with a good claims management systems storing all scanned documents together.

Mis-Sold Mortgage systems can also help with the commercial management of cases, scheduling and automating the recovery of initial audit charges and final commissions from clients, and simplifying the tracking of commissions when working with multiple firms of solicitors.

How Logiclaim Mis-Sold Mortgage claims software helps you manage your caseload.

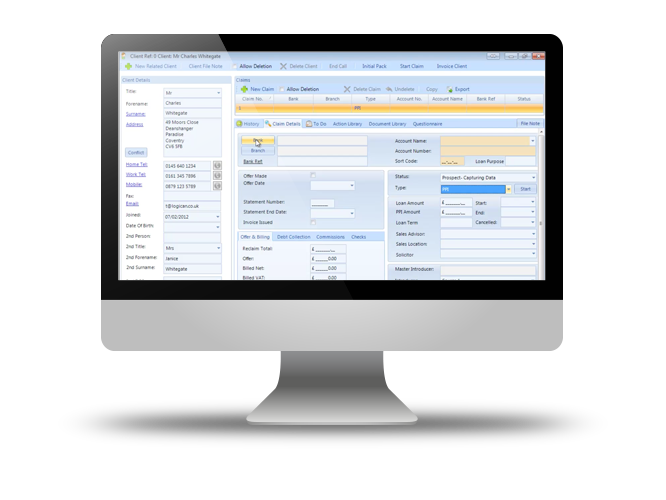

Logiclaim is purpose built claims management software ideal for running Mis-Sold Mortgage claims efficiently and profitably. It’s the Mis-Sold Mortgage claims software chosen by some of the leading claims practices handling MSM work.

Developed by Logican, specialists in business process management software and in process automation, Logiclaim automates key routine process tasks associated with managing Mis-Sold Mortgage claims over their often lengthy lifecycle.

Unlike other Mis-Sold Mortgage claim systems, LogiClaim enables all aspects of each claim to be easily recorded, stores all documentation and automates client acquisition so that chaser emails and SMS messages are sent out, and documents printed in bulk when they are due.

Logiclaim also has a powerful scanning facility, with barcode functionality, that automatically links incoming documents to the relevant claims and schedules an appropriate response.

With regard to the commercial aspects of running a claims business, Logiclaim provides an automated facility to track the commissions due to multiple firms of partner solicitors.

In addition, it will automate chasers for outstanding invoices, and includes a payment plan module that allows Mis-Sold Mortgage claim clients to pay in instalments. (This can even be integrated with the external Payment Gateway so that payments are taken automatically on their due date.)